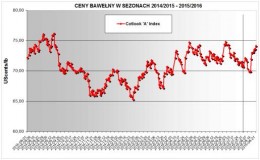

World cotton production in the 2014/2015 season remained on the level close to the past two seasons – ca. 26,2 mln tonnes. As the world cotton consumption was 24,4 mln, at most, the surplus production this season will be 1,8 mln tonnes. Accumulated figure from five subsequent season has already been 14,5 mln tonnes. Cotton surplus increased the world stock which in the 2014/2015 season reached the level of ca. 22 mln tonnes (11-month processing volume of the world cotton industry). Chinese stock increased to 12,6 mln tonnes, but never noted level of – 8,2 mln tonnes was hit in other regions of the world. After Chinese production has dropped by 0,5 mln tonnes, India – with the production of ca. 6,5 mln tonnes, is now the greatest cotton producer in the world. World cotton consumption increased by ca. 0,61 mln tonnes thanks to the increase of processing in China (+180 thousand tonnes), India (+160 thousand tonnes), Bangladesh (+70 thousand tonnes), in Pakistan (+60 thousand tonnes and in the USA (+30 thousand tonnes). World cotton turnover dropped by ca. 1 mln tonnes, reaching in the 2014/2015 season ca. 7,7 mln tonnes. Imports to China have been estimated at 1,8 mln tonnes at most, whereas imports of cotton to Bangladesh and Vietnam increased to the impressive values – of 1 mln tonnes and 0,92 mln tonnes, respectively. USA and India still are the greatest cotton exporters – 2,33 and 0,98 mln tonnes respectively. Due to the 5-year cotton overproduction and great world stock, in the 2014/2015, medium staple cotton prices have been very stable and foreseeable at the level lowest since 2009 – seasons average Cotlook A Index in 2014/2015 is 70,70 UScents/lb. A moderate demand for yarn and stable prices of cotton, in last season keep the cotton yarn prices at a considerably low and stable level. Irrespective of the fact that since the beginning of 2015 prices of polyester staple fibres have stabilised – in season 2014/2015, they have been on the level lower than cotton prices.